Understanding Auto Coverage Options in India

Navigating the complex world of auto insurance in India requires understanding various coverage types, policy features, and regulatory requirements. With mandatory third-party coverage and optional comprehensive plans available, choosing the right protection for your vehicle involves evaluating personal needs, budget constraints, and risk factors specific to Indian road conditions.

Car insurance in India operates under a dual framework where third-party liability coverage is legally mandatory while comprehensive protection remains optional. The Motor Vehicles Act mandates that every vehicle owner must maintain valid insurance, making it essential to understand available options before making coverage decisions. Indian insurers offer various policy structures designed to meet different financial capabilities and protection requirements.

How to Choose Car Insurance That Matches Your Requirements

Selecting appropriate coverage begins with assessing your specific circumstances and risk exposure. Vehicle age, usage patterns, and geographical location significantly influence insurance needs. Urban drivers face different risks compared to rural vehicle owners, including higher theft rates and accident frequencies. New vehicle owners typically benefit from comprehensive coverage, while older vehicle owners might consider third-party policies sufficient depending on their vehicle’s current market value.

Personal financial capacity plays a crucial role in coverage selection. Higher deductibles reduce premium costs but increase out-of-pocket expenses during claims. Evaluating your emergency fund availability helps determine suitable deductible amounts without compromising financial stability during unexpected incidents.

Simple Tips for Selecting the Right Car Insurance Plan

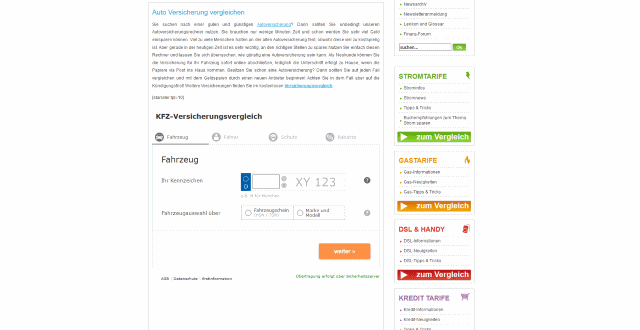

Comparing multiple insurers ensures optimal value and coverage alignment. Premium rates vary significantly between companies for identical coverage levels, making thorough research essential. Online comparison platforms simplify this process by displaying multiple quotes simultaneously, though direct insurer consultations often reveal additional benefits or discounts.

Reading policy documents carefully prevents coverage surprises during claims. Understanding exclusions, claim procedures, and coverage limits helps set realistic expectations. Many policies exclude specific scenarios like driving under influence, using vehicles for commercial purposes without proper endorsements, or damages during natural calamities in certain regions.

Network garage availability affects convenience during repairs and claims. Insurers with extensive cashless garage networks reduce upfront payment requirements and streamline repair processes. Proximity of network garages to your residence or workplace influences practical coverage benefits.

A Guide to Finding Car Insurance That Works for You

Digital platforms have revolutionized insurance purchasing in India, offering instant quotes, policy comparisons, and online documentation. Mobile applications enable policy management, claim tracking, and renewal reminders, enhancing customer experience significantly. However, understanding policy terms remains crucial regardless of purchase channels.

Customer service quality varies between insurers, affecting claim settlement experiences. Researching insurer reputation through customer reviews, claim settlement ratios, and regulatory ratings provides insights into service reliability. The Insurance Regulatory and Development Authority of India publishes annual reports containing insurer performance metrics useful for informed decision-making.

| Insurance Provider | Coverage Type | Annual Premium Range (₹) |

|---|---|---|

| ICICI Lombard | Comprehensive | 8,000 - 25,000 |

| Bajaj Allianz | Third-party + Own Damage | 7,500 - 22,000 |

| HDFC ERGO | Comprehensive | 8,500 - 26,000 |

| New India Assurance | Basic Comprehensive | 6,500 - 20,000 |

| Tata AIG | Premium Comprehensive | 9,000 - 28,000 |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Renewal timing affects premium costs and coverage continuity. Renewing policies before expiration maintains no-claim bonus benefits and prevents coverage gaps. Many insurers offer renewal discounts for early renewals, though comparing alternatives during renewal periods often reveals better options.

Additional coverage options like roadside assistance, engine protection, and zero depreciation enhance policy value but increase premium costs. Evaluating these add-ons based on personal requirements and budget constraints ensures optimal coverage without unnecessary expenses. Urban drivers might prioritize theft protection while highway travelers benefit more from roadside assistance coverage.

Understanding claim procedures beforehand expedites settlement processes during emergencies. Most insurers require immediate incident reporting, proper documentation, and adherence to prescribed procedures. Maintaining digital copies of policy documents, vehicle registration, and driving licenses facilitates smoother claim experiences.